LTC Price Prediction: Oversold Technicals Meet Regulatory Delays - October Catalyst Ahead

#LTC

- Technical indicators show LTC in oversold territory with improving momentum signals

- SEC ETF delay until October 2025 creates near-term uncertainty but provides clear catalyst timeline

- Broader institutional crypto interest supports altcoin sentiment despite regulatory hurdles

LTC Price Prediction

Technical Analysis: LTC Shows Oversold Conditions with Potential Reversal Signals

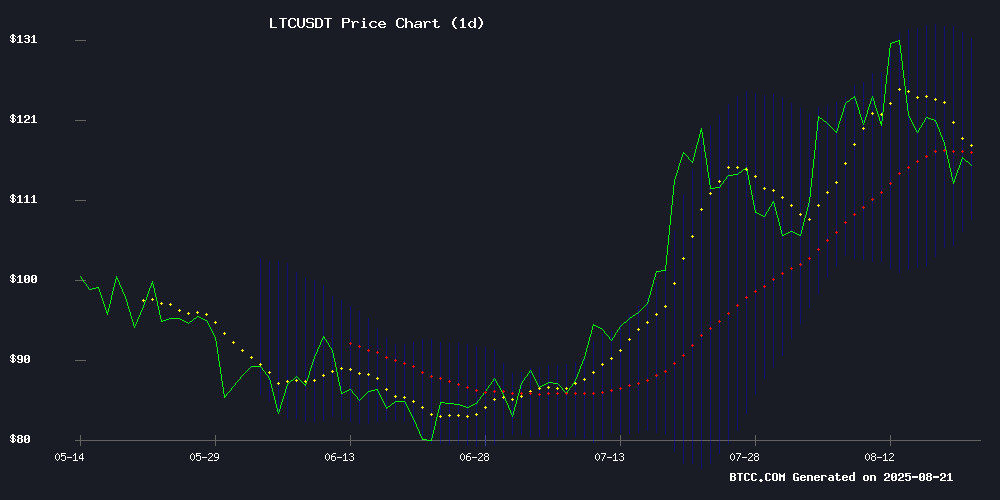

LTC is currently trading at $114.99, below its 20-day moving average of $119.64, indicating short-term bearish momentum. The MACD reading of -1.61 versus -4.47 signal line shows improving momentum despite negative territory, with a positive histogram of 2.86 suggesting weakening downward pressure. Bollinger Bands position LTC NEAR the lower band at $108.21, typically indicating oversold conditions. According to BTCC financial analyst Michael, 'The technical setup suggests LTC may be approaching a potential reversal zone, with the MACD divergence and Bollinger Band positioning hinting at possible upward movement toward the middle band around $119.64.'

Regulatory Delays and Institutional Interest Shape LTC Outlook

The SEC's decision to delay LTC ETF approvals until October 2025 creates near-term uncertainty but maintains long-term potential for institutional adoption. Meanwhile, the broader cryptocurrency sector is experiencing significant institutional inflows, particularly in Ethereum, which often creates positive spillover effects for major altcoins like Litecoin. BTCC financial analyst Michael notes, 'While ETF delays present short-term headwinds, the continued institutional interest in crypto assets and LTC's positioning among top ROI cryptocurrencies for 2025 suggests underlying strength. The October timeline provides a clear catalyst horizon for investors.'

Factors Influencing LTC's Price

Highest-ROI Crypto 2025: BlockDAG, XRP, Litecoin & Cardano Position for Growth

Investors are increasingly focusing on cryptocurrencies with robust fundamentals and clear growth trajectories as 2025 approaches. BlockDAG, XRP, Litecoin, and Cardano emerge as standout projects, each offering unique value propositions—from presale momentum to payments innovation and blockchain scalability.

BlockDAG has captured attention with its $377 million presale, combining Directed Acyclic Graph technology with Proof-of-Work security. Early investors have seen paper gains exceeding 2,600%, with analysts projecting a $1 valuation post-listing. The project's EVM compatibility further enhances its appeal for ethereum developers.

XRP continues to drive payments innovation, while Litecoin maintains its position as a reliable transactional asset. Cardano's methodical approach to smart contracts and scalability keeps it at the forefront of blockchain development. These projects exemplify the convergence of adoption potential and technical roadmaps that could deliver both short-term gains and long-term value.

SEC Delays XRP, SOL, LTC ETFs Until October 2025: Approval Still in Play

The U.S. Securities and Exchange Commission has deferred decisions on spot ETF applications for XRP, Solana, and Litecoin until October 2025. The delay affects proposals from major asset managers including Bitwise, Grayscale, and CoinShares, maintaining regulatory uncertainty while keeping approval pathways open.

Market analysts draw parallels to Bitcoin and Ethereum ETF precedents, suggesting eventual approval remains plausible. "The timeline extension reflects standard procedural review rather than outright rejection," said Nate Geraci of The ETF Store. Institutional interest continues to build despite regulatory hurdles.

Ethereum Surges Past Bitcoin with $2.87 Billion Inflows as Institutional Interest Peaks

Digital-asset investment products witnessed a staggering $3.75 billion influx last week, propelling assets under management to $244 billion by August 13. Nearly all inflows originated from a single U.S. provider, with Ethereum capturing 77% of the total at $2.87 billion—eclipsing Bitcoin's $552 million intake. Institutional momentum, not retail participation, drove the rally.

The dominance of concentrated flows through one iShares product underscores how targeted institutional moves can sharply impact overall AUM. Ethereum now represents nearly 30% of crypto fund assets versus Bitcoin's 11.6%, marking a seismic shift in institutional portfolio allocation. solana and XRP followed with $176.5 million and $126 million respectively, while minor outflows hit Litecoin and Ton.

Is LTC a good investment?

LTC presents a mixed but potentially attractive investment opportunity at current levels. Technically, the cryptocurrency shows oversold conditions with improving momentum indicators, suggesting potential for near-term recovery toward the $119-120 resistance zone. Fundamentally, while ETF approval delays create short-term uncertainty, the October 2025 deadline provides a clear catalyst timeline.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $114.99 | Below 20-day MA, oversold |

| 20-day MA | $119.64 | Potential resistance level |

| MACD Histogram | +2.86 | Positive momentum building |

| Bollinger Position | Near Lower Band | Typically indicates buying opportunity |

BTCC financial analyst Michael suggests, 'For risk-tolerant investors, current levels may offer an attractive entry point with a 6-8 week horizon toward October's ETF decision. However, traders should monitor the $108 support level closely.'